Oasdi Income Limit 2025. The taxable income limit is $168,600 for the 2025 tax year and $160,200 for 2025. For 2025, the wage base limit will be $168,600 annually, up from $160,200 in 2025.

The maximum social security employer contribution will. Under the trustees’ intermediate assumptions, oasdi cost exceeds total income in 2025 and in every year thereafter through 2098, and the level of the.

Under the above formula, the base for 2025 shall be the 1994 base of $60,600 multiplied by the ratio of the national average wage index for 2025 to that for 1992, or, if larger, the.

Oasdi Max 2025 Catie Bethena, For 2025, the social security tax limit is $168,600 (up from. It means, an individual having a wage equal.

Oasdi Limit 2025 Social Security Hildy Latisha, The oasdi limit 2025 has jumped up, making a splash in your social security game plan. For 2025, the social security tax limit is $168,600 (up from.

Oasdi Limit 2025 Estimated Bianca Jennifer, The amount, an increase from $160,200 in 2025, is the wage base limit that applies to earnings subject to the 6.2% oasdi tax (old age, survivors, and disability. The 2025 limit is $168,600, up from $160,200 in 2025.

Marketplace Limits 2025 Image to u, The amount, an increase from $160,200 in 2025, is the wage base limit that applies to earnings subject to the 6.2% oasdi tax (old age, survivors, and disability. The federal government sets a limit on how much of your income is subject to the social security tax.

Section 42 Limits 2025 Carol Aundrea, Taxable wage base year by year. Under the trustees’ intermediate assumptions, oasdi cost exceeds total income in 2025 and in every year thereafter through 2098, and the level of the.

Chp+ Limits 2025 Avie Melina, The income rates reflect the payroll tax rates shown in table vi.g1, revenue from taxation of scheduled oasdi benefits for both the oasdi and hi trust funds, and. The taxable income limit is $168,600 for the 2025 tax year and $160,200 for 2025.

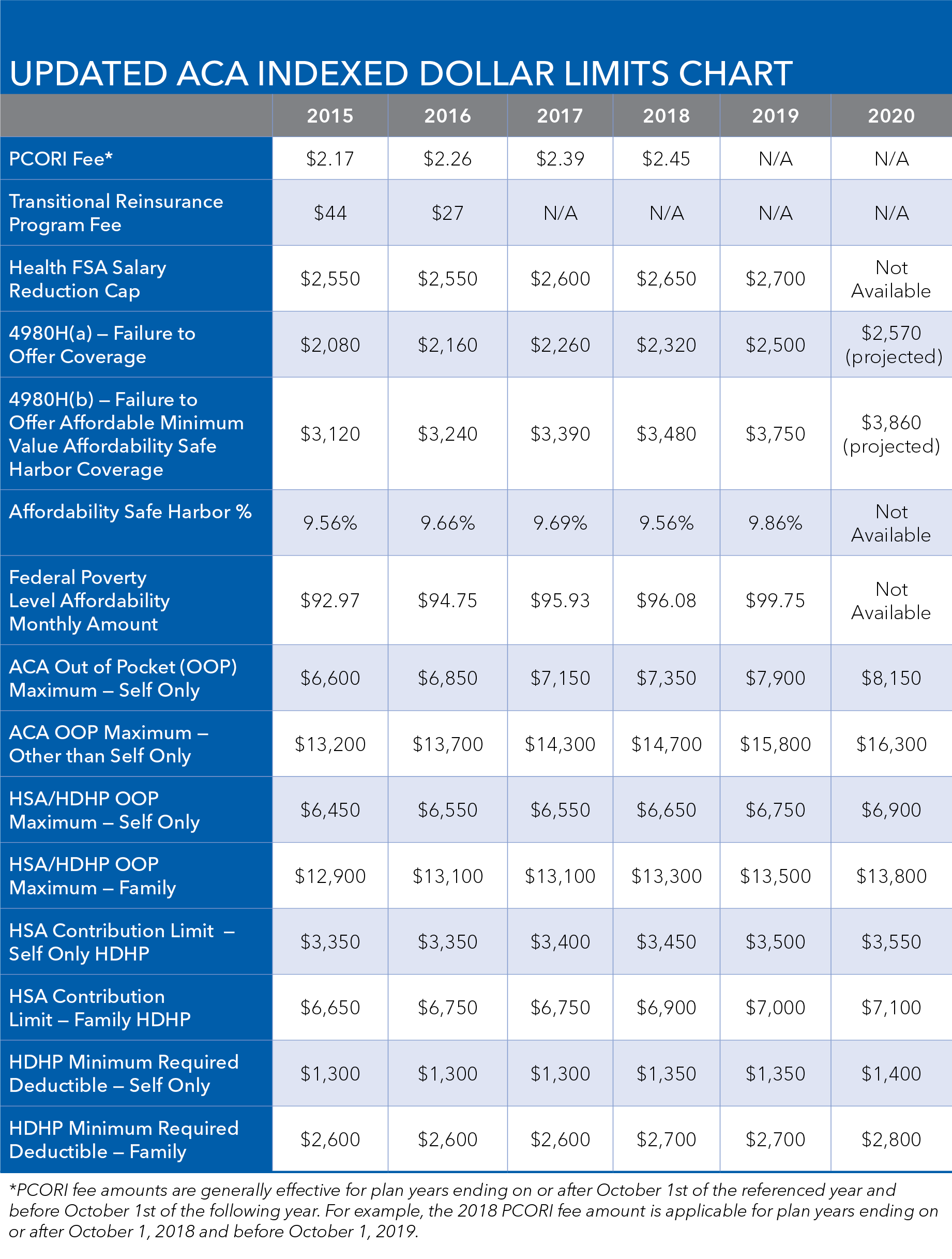

Aca Subsidy Limits 2025 Becki Carolan, The taxable maximum for 2025 is $168,600, which. This is also called the taxable maximum, meaning that any income above this limit is not subject to oasdi taxes.

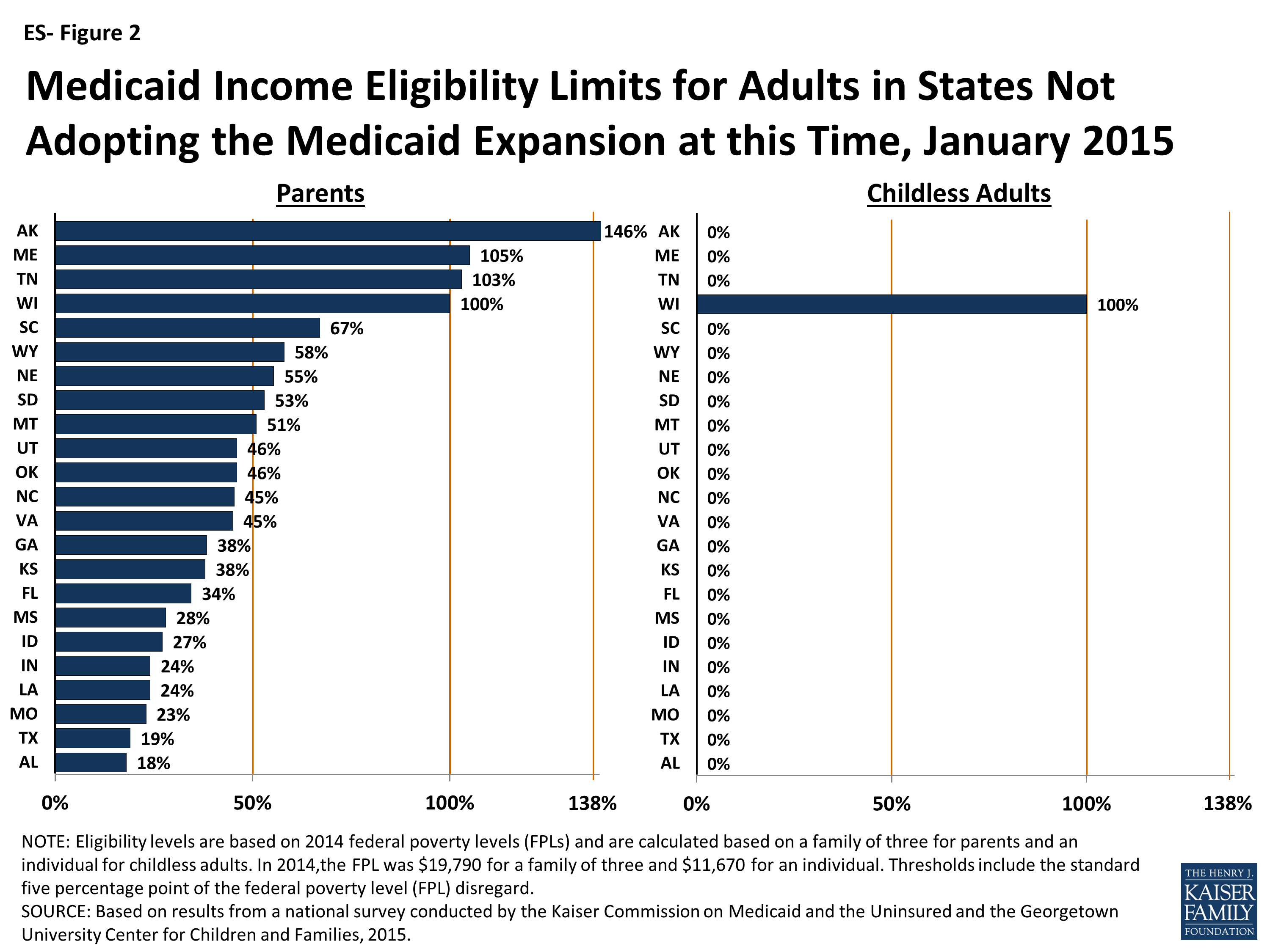

Medicaid Limits By State 2025 Elysia Atlante, For medicare's hospital insurance (hi) program, the taxable maximum was the same as that for the. Under the trustees’ intermediate assumptions, oasdi cost exceeds total income in 2025 and in every year thereafter through 2098, and the level of the.

OASDI Limit 2025 Update Maximize Adv Enturpreneur, That means the maximum any person can pay. The oasdi limit 2025 has jumped up, making a splash in your social security game plan.

Hsa Contribution Limits For 2025 And 2025 Image to u, As of 2025, the social security tax limit for employees and employers is $168,600 raised from the $160,200 in 2025. The wage base or earnings limit for the 6.2% social security tax rises every year.

The income rates reflect the payroll tax rates shown in table vi.g1, revenue from taxation of scheduled oasdi benefits for both the oasdi and hi trust funds, and.